Because the Labor Burden shown in the Markups Detail region is usually a composite of multiple Payroll Classes' burdens, you simply cannot enter a value for Labor Burden when viewing a Section's Markup Detail - there's no way for program to know where and how to adjust the individual components to create that composite value.

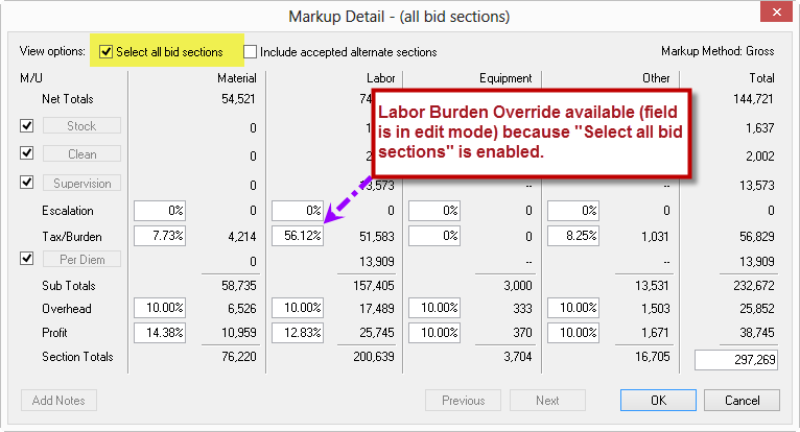

However, when viewing the Bid (cumulative) Markup Detail (clicking the "All Bid sections..." checkbox), you are able to override these individual burdens and apply a single burden percentage to all Payroll Classes, across the Bid.

This article covers adjusting Labor

Burden, if you want to adjust Production, see Related Articles.

- Alternates share Base Bid Payroll Settings and Labor Burden configuration, so Labor Override cannot be performed on an Alternate - it must be performed on the Base Bid.

- Change Orders Payroll Settings, on the other hand, can be unique and therefore, Labor Override is available if you are looking at "All Sections" of a Change Order.

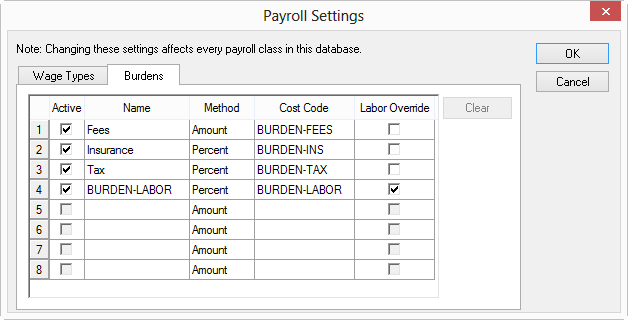

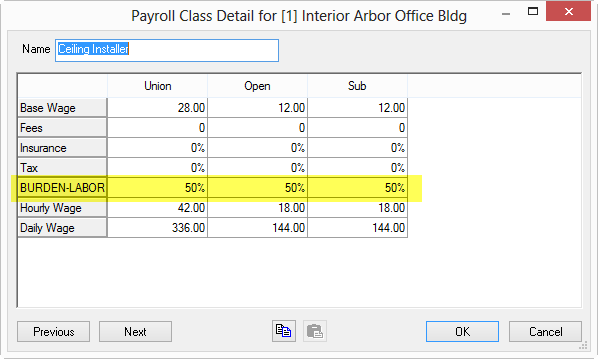

First, before Labor Burden can be overridden, there must be a Burden set as "Labor Override" in Payroll Settings, see below. All Labor Burden is then allocated to this single burden when an override is performed. In the example below BURDEN-LABOR is the override code so if you were to set an override percent, the Payroll Classes' individual burdens would be zeroed out and set to this "Override" burden.

Review Related articles for detailed information setting up your Labor Burdens.

The Labor Burden marked "Labor Override" in the Payroll Settings dialog is the burden to which overridden Labor Burden amounts will be applied - Labor Burden will no longer be broken out by Fees, Insurance, Tax, etc. - they will be 'lumped' into this one burden. See Related articles for more information. Labor Burden override can only be performed when viewing "All Bid Sections" because a Payroll Class can be used in any number of Sections.

To Override Labor Burden

Open the Markup Tab.

Click on the name of a Bid or Change Order in the Bids/Sections grid (at the top of the Tab) (notice, "Select all bid sections" becomes checked) (see previous articles for more information on the View options function).

When a single Bid Section is selected (even if it is the only Section in your Bid),

Labor Burden Override is not available - Labor

Burden Override is only available when "

Select all bid sections" is checked.

The Labor Burden field becomes a text-entry box, where you can enter in an override value:

If "Include accepted alternate sections" is selected when setting Labor Override for the base Bid, then the Labor Override will be applied to Bid Sections/Payroll Classes used exclusively in Accepted Alternates (in addition to those used in the base Bid).

Entering an Override Value

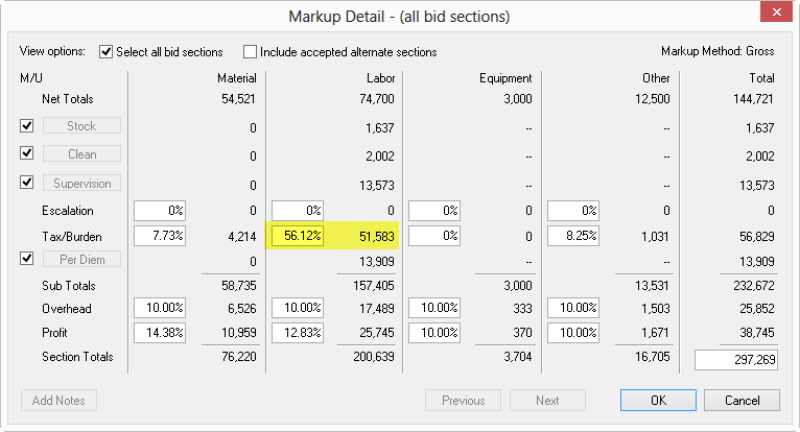

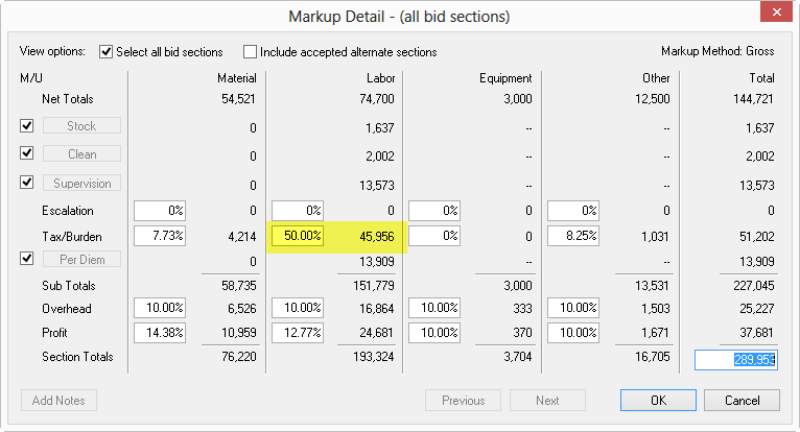

Before overriding the Labor Burden, Quick Bid calculated the combined (All Sections) Tax/Burden value at 56.12%. This means, for all Bid Sections, all Payroll Classes, the combined, overall Tax/Burden % is 56.12.

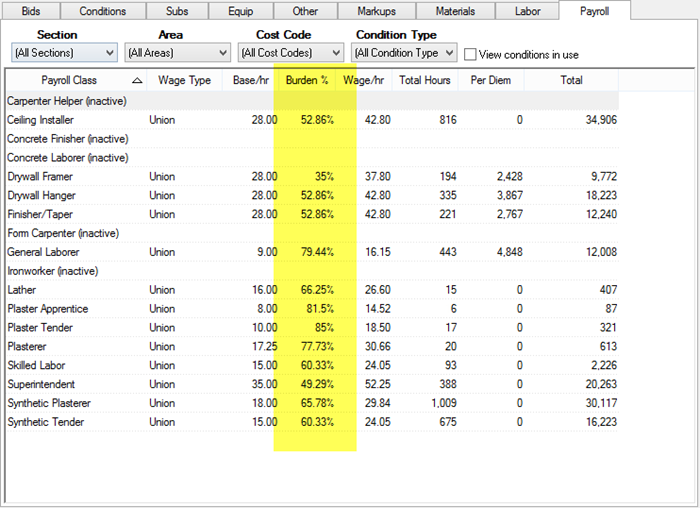

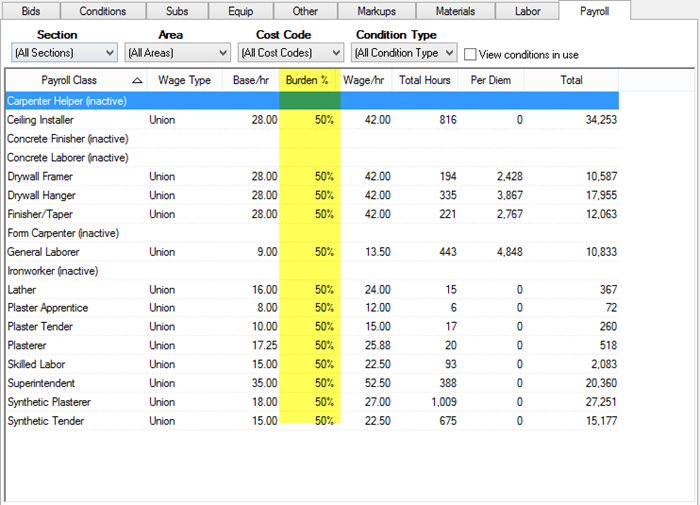

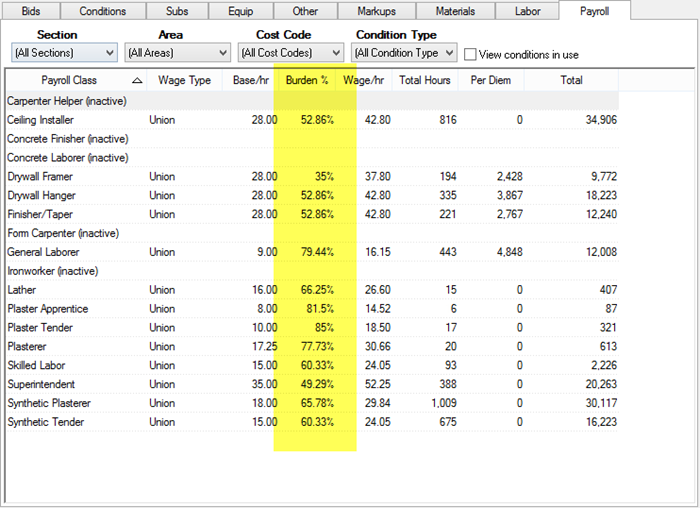

On the Payroll Tab, we can see the different Burden % for each Payroll Class...

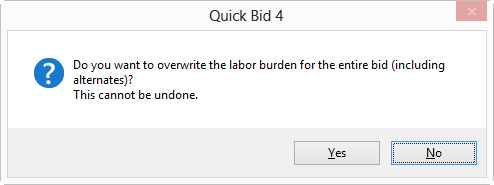

Back on the Markups Tab, enter the new Labor Burden % (for example, we entered '50', below) and hit <Enter> - a confirmation dialog displays reminding you that this will override burdens Bid-wide.

Once you click Yes all default/custom burdens are zeroed out and the new percentage is applied to the Labor Override burden for all Payroll Classes.

Overriding Labor

Burden cannot be undone! If in doubt, duplicate your Bid before making this change.

After changing to 50%, Tax/Burden for Labor is set to 50% for every Section...

On the Payroll Tab, we can see that the Burden % is set to the value entered on the Markups Detail screen.

The Burden percentage for all Payroll Classes is set to the value entered on the Markup Detail.

Double-click on any Payroll Class on the Payroll Tab to view the Payroll Class Detail. Notice, the Labor Override affects every Wage Type for every Payroll Class...

All Burdens (Fees, Insurance, Tax, etc.) except for the one marked Labor Override, in Payroll Settings, are set to zero after the Burden override function is used.

This cannot be undone, although you can customize Labor Burdens for each Payroll Class again via the Payroll Tab or Restore default values...

Restore Default Payroll Wages and Burdens (Refresh Payroll Wages)

When Burdens are overridden on the Markups Detail screen, they can be restored to the defaults stored in Payroll Settings.

Click Bid > Refresh Payroll Wages a confirmation displays...

Once the defaults are reapplied, the Payroll Tab shows the updated Burden %...

You can make adjustments to the Selling Price of a Section or the entire bid.