Before you start pricing Bids, it is best to set up payroll Wage Types and Burdens because these settings affect all labor costs, in all Bids.

- First, set up Wage Types (different types of wages - for example, we include Open, Union, Sub, but you may have ones for different Regions, States, or Municipalities, etc.)

- Then, add Burdens (extra fees or expenses added onto a base wage - such as Taxes, Union Fees, Insurance, etc. These burdens often these vary by "Wage Type" and do not have to be setup for each Wage Type.)

- After you've setup Wage Types and Burdens, you setup your Payroll Classes in Masters. This is covered in the next Chapter. You will need Wage Types and Burdens configured before you can add Payroll Classes (although you can setup Payroll Classes "on the fly" as you are bidding, you must set up Wage Types and Burdens before you start).

Adding/Configuring Burdens

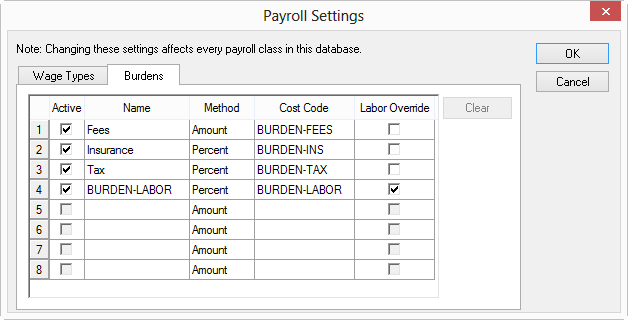

In the Payroll Settings dialog box, the Burdens tab allows for configure additional payroll costs such as: Fees, Insurance, Tax and Labor (default burdens, but may be modified). The Method and Cost Code for each burden may be modified at any time. A maximum of eight burdens may be entered. You can configure the percents and amounts for Burdens added here in each Payroll Class you setup in the Masters.

To set up Burdens,

Click Tools > Payroll Settings - the Payroll Settings dialog opens.

Click the Burdens tab.

To create a new burden, enter a name in an open field.

To change the name of a burden, select it and type over the existing name.

Enter a Method for calculating burden.

When viewing the Markup

Detail, Quick Bid combines all Burdens and displays them as a single percentage. Burdens entered as monetary amounts are converted to percentages and then added to the Burdens that are entered as percentages. Example: A benefit package entered at $12.50 per hour, with a base rate of $25.00, would be converted to 50% of Base Rate. If

tax and insurance amounted to 25%, Quick Bid would show total

burden as 75% at the Markup

Detail.

Burdens are applied to the Base Rate, not to other Burdens. For example,

tax or insurance (usually entered as a percentage) applies to the

base rate but not to a benefit package entered as a value, not a percentage

- Amount - a (monetary) value which is added to the hourly base rate. An example would be a union benefit package entered as $12.50 per hour.

- Percent - uses a percentage to factor burden, not a set dollar value. The percentage is entered as a whole number rather than a decimal factor. Example FICA tax is entered as 7.65%.

Enter a Cost Code or click the Lookup tool  to select from a list.

to select from a list.

Place a check in the Active box to make a burden available to Payroll Classes in the database.

To separate individual burdens on Bid Reports, you must assign a unique Cost Code to each line of burden. For example, if Workers Comp. Insurance is identified as a separate line item at the Burdens table, Quick Bid can isolate that cost on the Job Cost Summary report only if that Burden is assigned its own Cost Code.

Place a check in the box in the Labor Burden Override column to be able to override the individual burdens on the Markups Detail dialog - only one row can be selected as Labor Burden Override. To select a row for Labor Override, the method must be set to percent and the burden must be active. When you override Burden by entering a new % value in Markup Details, the entire amount will be allocated to the 'Override' burden, replacing the amounts previously configured. All this is covered in Chapter 5 - Additional Expenses and Markups.

Click OK to save changes or Cancel to close the dialog without saving changes.

To Remove a Burden from the List

Open Payroll Settings, then Burdens tab.

Click on the row to remove.

Click Clear to clear a burden from the list - a confirmation prompt displays.

- Click Yes, and if the burden is not in use, the burden row is cleared and the burden is removed from the database - if the burden is in use, it cannot be removed

- Click No to cancel the request

Click OK to save changes or Cancel to close the dialog without saving changes.

Now that you've setup preliminary payroll information (Wage Types and Burdens), you can configure wages and burdens for each Payroll Class, covered in the next Chapter - Masters.

Making changes to

Payroll Settings affects every Payroll Class in the current

database. Payroll Classes are covered in the next Chapter (Masters).