| |

| |

Quick Bid - 08.01 Viewing and Adjusting Bid Markups - Overview - QB

| Views: 768 Last Updated: 10/28/2024 01:58 pm |

0 Rating/ Voters

|

|

| Be sure to rate this article 5 Stars if you find it helpful! |

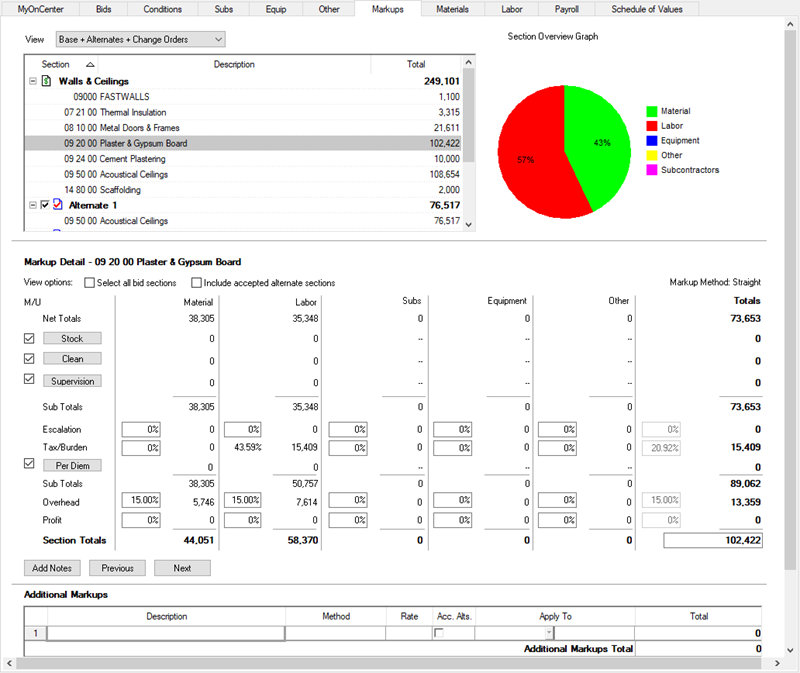

Markups come in three varieties in Quick Bid (the links below open in new browser tabs/windows): - Indirect Expenses refer to expenses related to Stock, Clean, Supervision, and Per Diem applied to individual Cost Codes or Payroll Classes.

- Section Markups refer to tax, burden, escalation, overhead, and profit, applied to each Section used in the Bid. They are applied to Material, Labor, Subs, Equipment, and Other costs. Markups are applied after Stock, Clean, and Supervision are applied, but before Per Diem.

- Additional Markups generally refer to fees and charges applied to or added to Bid totals. Additional Markups are sometimes referred to as Bid markups, however in Quick Bid, the term Additional Markups is used. Additional Markups are not associated with any Cost Code, Payroll Class, or Division/Section, they are lump-costs added onto the final Bid totals.

You may have setup Default Markups and Indirect Expenses when you setup Quick Bid - it is not required and many estimators do not because these "extra expenses" change so much from project to project.

At the Bid level, these markups are viewed and modified from the Markups Tab (see Related articles for more information about the Markups Tab and setting up default Markups and Indirect Expenses). Markups are applied using Gross or Straight margins, explained in the articles that follow. When you open the Markups Tab, be default, you are seeing Markups for the entire Bid (including all accepted Alternates and Change Orders, which are listed separately).

From the Markups Tab, click any section in the Bids and Sections grid, at the top of the Tab to see the Markup Detail for that Bid/Section.

Many estimators refer to Markups, Indirect Expenses, and Additional Markups as just "markups" - that's fine. We break them into three groups, just because each is calculated a little differently.

|

|

|