8.03.02 Labor Burden Override

Because the Labor Burden shown on the Markups Detail screen is usually a composite of multiple Payroll Classes' burdens, normally one cannot simply enter a value for Labor Burden on the Markup Detail.

However, when viewing the Bid Markups (clicking the "All Bid sections..." checkbox) you are able to override these individual burdens and apply a single burden percentage to all Payroll Classes, across the Bid.

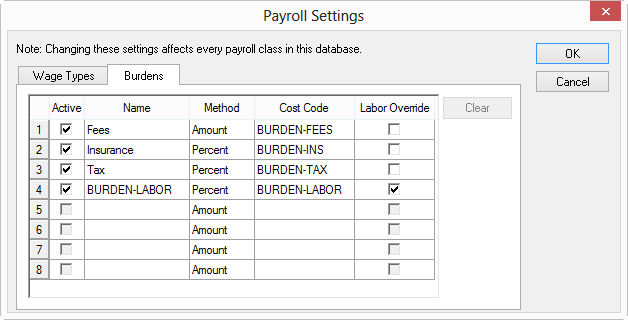

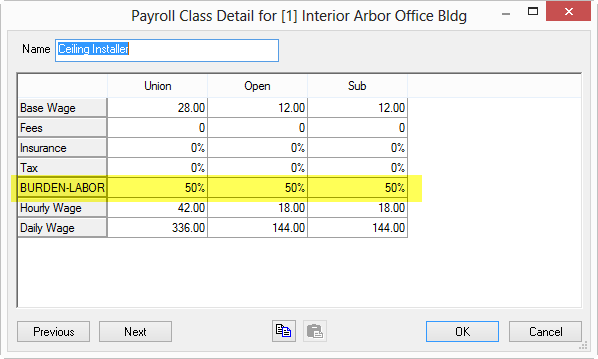

First, before Labor Burden can be overridden, there must be a Burden set as "Labor Override" in Payroll Settings, see below. All Labor Burden is then allocated to this single burden when an override is performed. In the example below BURDEN-LABOR is the override code so if you were to set an override percent, ALL Payroll Classes' burdens would be zeroed out and set to THIS single burden.

The Labor Burden marked "Labor Override" in the Payroll Settings dialog is the burden to which ALL Labor Burden amounts will be applied - Labor Burden will no longer be broken out by Fees, Insurance, Tax, etc. - they will be 'lumped' into this one burden. See Payroll Settings for more information. Labor Burden override can only be performed when viewing "All Bid Sections" because any Payroll Class can be used in any number of Sections.

Alternates share Base Bid Payroll Settings and Labor Burden configuration. Labor Override cannot be performed on an Alternate - it must be performed on the Base Bid. Change Orders, on the other hand, can use unique Payroll Settings and therefore, Labor Override is available in a Change Orders's All Section Markup Detail.

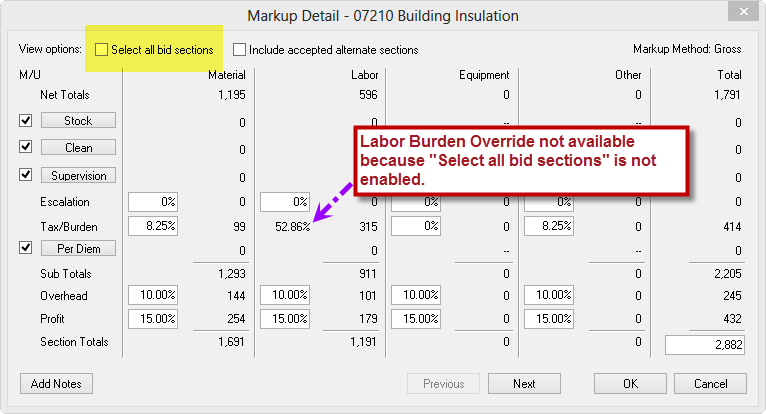

When a single Bid Section is selected, Labor

Burden Override is not available - Labor Burden Override

is only available when "Select all bid sections"

is enabled. Notice, in a Section Markup Detail, the Labor Override

is not available:

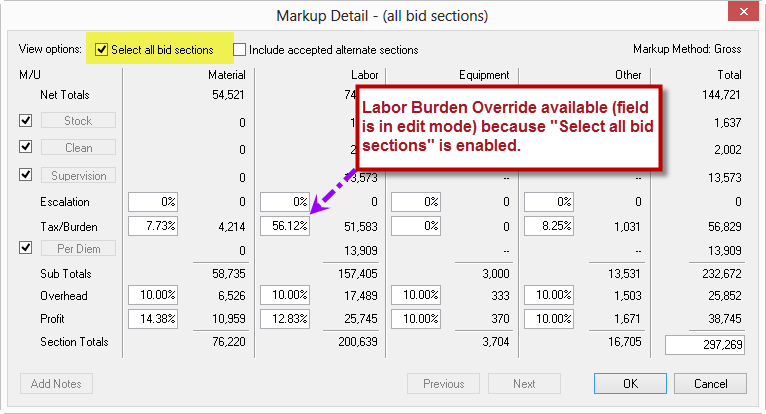

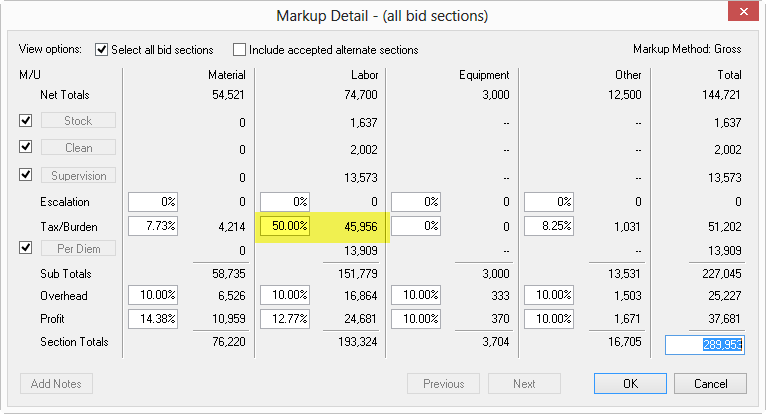

When you click "All Bid Sections", the Labor Burden field becomes a text-entry box, where you can enter in an override value:

If "Include accepted alternate sections" is selected when setting Labor Override for the base Bid, then the Labor Override will be adjusted for Bid sections/Payroll Classes used only in Accepted Alternates in addition to those used in the base Bid.

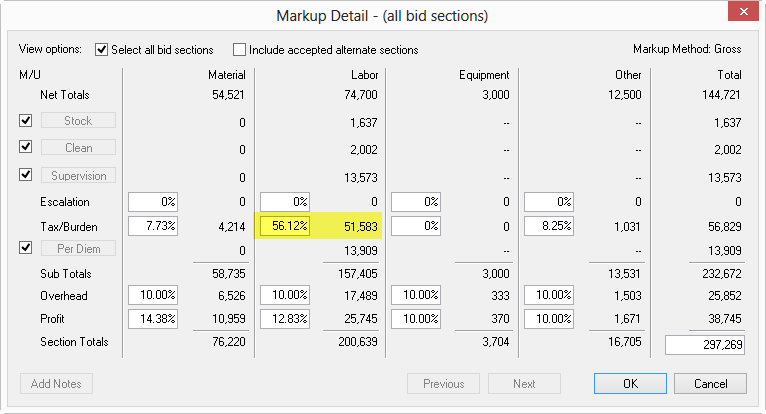

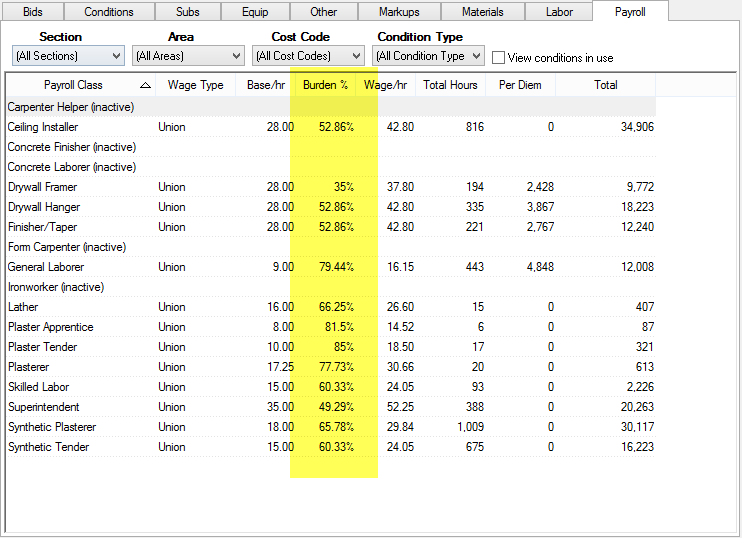

Before overriding the Labor Burden, Quick Bid calculated the combined (All Sections) Tax/Burden value at 56.12%. This means, for all Bid Sections, All Payroll Classes, the combined, overall Tax/Burden % is 56.12.

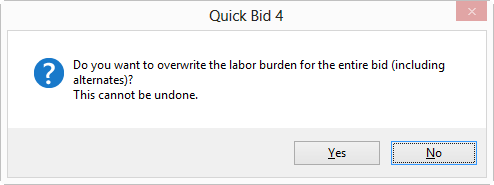

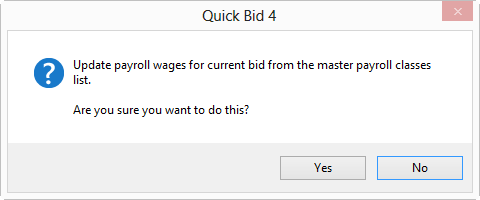

Once you click Yes all default/custom burdens are zeroed out and the new percentage is applied to the Labor Override burden. This change cannot be undone! If in doubt, duplicate your Bid before making this change.

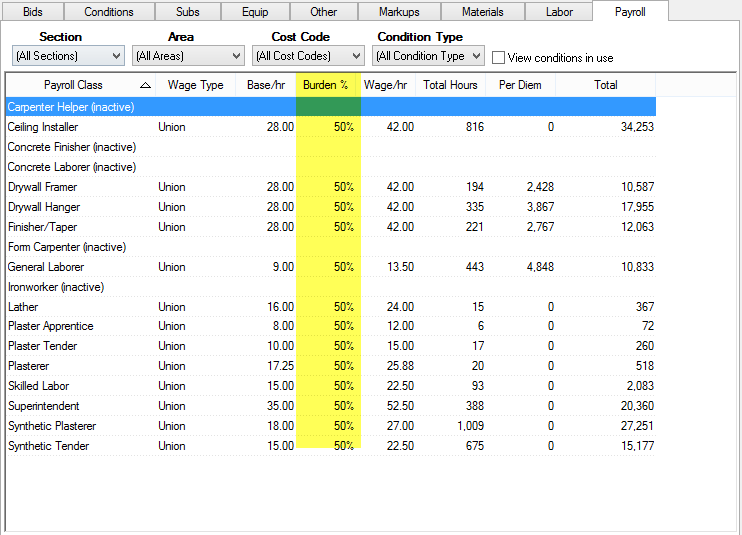

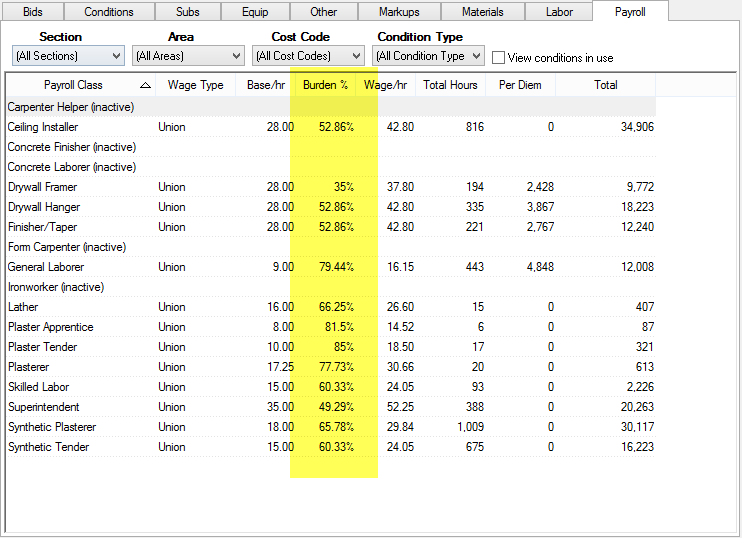

After changing to 50%, Tax/Burden for Labor is set to 50% for EVERY Section...

The Burden percentage for all Payroll Classes is set to the value entered on the Markup Detail.

Double-click on any Payroll Class in the Payroll Tab and the Payroll Class Detail dialog opens. Notice, the Labor Override affects every Wage Type for every Payroll Class...

All Burdens (Fees, Insurance, Tax, etc.) except for the one marked Labor Override, in Payroll Settings, are set to zero after the Burden override function is used.

This CANNOT be undone although Labor Burdens can be changed again for any Payroll Class via the Payroll Tab.

When Burdens are overridden on the Markups Detail screen, they can be restored to the defaults stored in Payroll Settings.

Once the defaults are reapplied, the Payroll Tab shows the updated Burden %:

This covers Markups and Indirect Expenses applied to Bid Costs (Material, Labor, Subs, Equipment, and Other). See the next article for adding costs (Additional Markups) to your Bid that are not directly (or indirectly) related to Material, Labor, etc. For example, permits, legal fees, surveillance charges, etc.